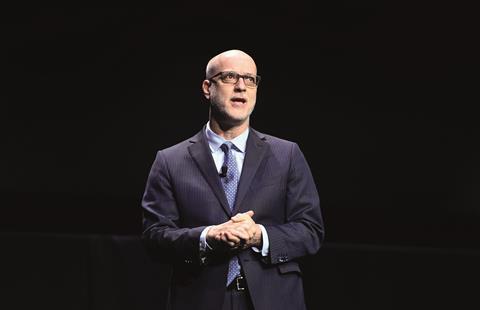

John Fithian attends CinemaCon this month in his final appearance as president and CEO of the National Association of Theatre Owners (NATO). Fithian initially served as outside counsel to the exhibition trade organisation from 1988-99 while an attorney at Patton Boggs in Washington DC, before joining NATO full-time in January 2000. He has been a dedicated and genial figurehead over more than two decades at the helm, working closely with the Motion Picture Association to promote the interests of the exhibition sector.

In that time, NATO and the broader industry have faced existential threats to cinemagoing, from the rise of streaming to day-and-date releases to a global pandemic. During Covid, NATO lobbied US federal and local government officials for support to help theatres and their staff, from the top to bottom of the food chain, amid the most challenging time the sector has ever faced.

On the back of an encouraging 2022 powered by Top Gun: Maverick, Black Panther: Wakanda Forever and Avatar: The Way Of Water — which saw North American box office climb 65% on 2021 to reach $7.54bn, still 33% below pre-pandemic 2019’s $11.36bn — Fithian talked to Screen International about the key issues facing theatre owners.

After years hopping from Hollywood to Washington DC, the executive steps down from his post on May 1, when Michael P O’Leary, Entertainment Software Association’s senior VP of government affairs, will take the reins. NATO’s annual trade convention CinemaCon runs from April 24-27 in Las Vegas.

How do you feel about the health of exhibition as we emerge from the pandemic?

Part of the reason I am comfortable retiring on May 1 is that I’m very confident about where the exhibition industry is going. I don’t mean to underestimate the fact the top line for exhibitors hasn’t come back fully to pre-pandemic levels yet and a lot of costs have risen — labour costs, energy costs, real-estate rentals or purchases — but the thing that’s most encouraging is that our patrons are coming out on a per-movie basis in the same numbers or stronger than they were pre-pandemic. If you just look at 2022, for example, we had about 63% of the wide releases [more than 2,000 screens in North America] that we had in 2019, and they collectively delivered 64% of the box office that wide releases yielded in 2019. So it’s all about movie supply.

Moviegoers have shown they are absolutely desperate to get back to the movies and are coming out in incredible numbers. The movie schedule just kicked into high gear [in March] and the outlook for the rest of this year is very strong.

The exclusive theatrical window in the US has shrunk to an average of 45 days. How do you feel about where we are now?

What we’ve evolved to isn’t a one‑size-fits-all model and that’s a good thing. Movies that are working really well might have an 80 or 90-day window. Some movies have, because of agreements, a 17-day window before premium video on demand, whereas there’s another type of arrangement on windows for streaming.

We still believe very firmly that a robust theatrical window not only allows movies to make money in theatres, it also makes the pop on the streaming service much better when it happens. We are getting good signals out of two of the three big streaming services about more theatrical releases with robust windows, and that’s very encouraging.

You’re talking about Amazon’s Prime Video and Apple?

Yes. Creed III was an MGM product so you knew that was going to go theatrically with a window [Amazon owns MGM]. But now with Air coming theatrically in April and not debuting on [Prime Video] until late May or something like that, Amazon is looking at wide theatrical releases — that’s a pretty good signal of where it might be headed. They’ve finally got their new leadership team organised and we’re very encouraged.

We’re equally encouraged by Apple. They’ve got the rights on Marty Scorsese’s Killers Of The Flower Moon and Paramount are distributing that movie, so that’s an Apple title going for a big-time theatrical release with a window [scheduled for a limited release on October 6 before a wide expansion on October 20].

And it’s not just them. [President and CEO] David Zaslav at Warner Bros Discovery has been saying the same thing. The tide has turned on what the appropriate business model is and what Wall Street is saying about these publicly traded companies, so that’s all part of the optimism.

You said at CinemaCon 2022 that the door is always open to longer releases by Netflix.

Yes, I’ve said many times our members would love to play more Netflix pictures. Ted Sarandos [co-CEO] is a smart guy but the Glass Onion experiment [late 2022 exclusive theatrical release prior to the platform debut] was a half-step; it’s positive but it didn’t go wide enough and it only played theatrically for one week, so I’m a little mystified as to what the purpose of that was.

You also said day-and-date distribution was dead as a business model. Do you still maintain that?

I do. There just aren’t any big significant movies planned for a day-and-date release strategy right now. There are some little movies where companies are trying to get a marketing hit from a theatrical release at the same time it gets released in the home, but that’s just not where the model is moving and that’s not where Wall Street wants the model to move.

It was said during the pandemic that older audiences and families with young children would be hard to get back into theatres. True?

The numbers show the opposite. Top Gun: Maverick appealed to lots of seniors. If you look at the numbers on smaller movies like 80 For Brady, which is obviously targeted to an older audience, these numbers are as good or better than those types of movies did before the pandemic. There just haven’t been enough movies that appeal to older demographics.

It’s the same for families. So many people thought during the pandemic they didn’t have to go to movie theatres anymore because it was all going to be available immediately on Disney+. That was a mistake and Disney are retooling their release models and beginning to capitalise on longer windows doing business theatrically and driving Disney+. Almost company by company, it’s clear these models are moving in the right direction.

Is enough being done to capture younger audiences?

After we got out of the pandemic, there were not enough family titles in the pipeline so we would go months without a new big family title and that’s almost still the case up to today. We had one significant family title released during the holidays [Puss In Boots: The Last Wish]. That’s just not enough to get them back out in strong numbers — and that, too, seems to be changing, leading into the rest of 2023 to 2024. We are pretty confident that all the demographics are signalling they want to come to theatres to see good movies.

Surprisingly few North American theatres — about 5% — went out of business in the pandemic. Will more fall by the wayside?

We lost a couple of thousand screens domestically, out of an infrastructure of around 42,000. It could have been a whole lot worse. What we’re seeing now is that as some companies are shutting down certain locations, others are remodelling and getting locations going again. Old sites that haven’t been refurbished properly probably should close permanently, unless there is another company that wants to invest.

We’ve seen very encouraging numbers from our members on how many PLFs [premium large-format screens] are being created, how many new digital sound systems are being installed, how many theatres have converted from traditional to luxury seating, how many theatres have innovations in food and beverage.

Coming out of the pandemic, there’s been a lot of investment back into the business. If we lose screens permanently because no-one wanted to refurbish that location, that’s probably appropriate under the evolving economic model.

Do you see exhibition adopting alternative content as a significant part of the business?

One of the great promises of digital cinema that was never fully executed was alternative content. Digital cinema brought lots of other benefits like consistency in video quality and more flexibility in programming, but we also hoped the alternative content business would grow more than it has. One of the bigger challenges and initiatives at NATO and [NATO non-profit] The Cinema Foundation is to look at ways to grow that kind of business: what kind of licences can be struck to bring in more sporting events, how can the studios maximise all their content, including their television programming, with some kind of a theatrical play. There have been a few good experiments with series premieres or finales in theatres and you’ll see more sports.

What are your views on dynamic and variable pricing?

It’s not the role of a trade association executive to talk about pricing models, because that’s a very competitive issue and antitrust laws are pretty clear about it. But I’m glad studios and exhibitors are working together on that and experimenting.

Where have you seen the most robust international growth?

China’s box office got hit hard by the pandemic. If government policy on theatres continues to be what it is now [opening up screens after long closures], that will be a rapidly growing market again. A lot of it will depend on what movies are allowed to play there and that’s a big question.

Southeast Asia has built amazing theatres and some of the locations I’ve seen in Thailand, the Philippines and Malaysia are mind-blowingly beautiful. There’s potential for substantial growth in Africa and the Middle East. We were part of the team that negotiated with the Kingdom of Saudi Arabia to get theatres reopened again pre-pandemic. Africa’s got promising spots: the film-loving communities in countries like Nigeria and South Africa are pretty substantial so you’ll see positive [developments] there.

Europe and North America are very much mature markets. Right before the pandemic we got to the level where we had a good number of modern theatres in all places for people to attend. There’s room for growth beyond a pre-pandemic box office if some of these earlier questions go the right way — if we get more titles with theatrical releases, for example.

For so many reasons beyond just the little exhibition industry, everyone’s hoping for an end to the Russia-Ukraine conflict very soon. Russia was one of the five biggest markets in the world for exhibition and now it’s been hit pretty hard. Obviously, Ukraine’s [exhibition sector] has been hit pretty hard too but that wasn’t a very big market.

Latin America has been pretty diverse in how governments responded to the pandemic and so the rise back up is different country by country, but I have confidence that Latin America will still be a very important market.

You’ll see the percentage of total box office out of globally released movies remain in the 60%-70% range, with the rest coming from domestic. That’s healthy for the business.

What has been your main regret?

I wish I’d never said from the stage of CinemaCon that I watched 12 Years A Slave at home instead of in a theatre. I [endured] a 48-hour press storm about what a stupid thing it was to say.

What have you loved about your tenure?

It has been a joyous ride of passionate members working together to accomplish great things and overcome challenges. It was so encouraging to see 100-plus movie directors speak out about the need to preserve cinema and to read [filmmaker] Chris Nolan’s op-ed in The Washington Post, and to talk to many in the creative community during a time of crisis about their belief in the art form and the business of theatrical release.

I was thrilled by the way the industry worked together during the pandemic. The industry rolled out the CinemaSafe plan to reassure customers they could come back and to get cinemas open again. The fundraising to help our employees through Will Rogers [Motion Picture Pioneers Foundation, which provides financial assistance and counselling for industry members during periods of hardship] and the unemployment compensation we lobbied to help them get — it was a historic coming together of interests to overcome the biggest challenge the movie business has ever faced.

What will be some of the biggest challenges for your successor?

Continuing to have NATO be a significant influence in both beating back challenging government proposals and encouraging helpful government proposals is always a key role for the trade association. Michael [P O’Leary] is very well equipped to do that at the federal and state level.

What we do in Hollywood is the other big priority of the association. The launch of The Cinema Foundation is a big part of that and I believe Jackie [Brenneman, EVP] running the foundation and Michael running NATO will be a good partnership. And the continued strengthening of the relationship between exhibition and the creative community in Hollywood is very important.

What’s next for you?

I will stay involved in the industry because I love it, but it’s time to give up the 18-hour days. The other part, personally, is that my wife is Greek, and the deal was that she would spend lots of time in America because that’s where my work and family was, and when I retired it was time to spend more time in Greece.

No comments yet