The release of Lionsgate’s much anticipated Michael will “likely” be pushed from October to sometime after March next year, company executives have confirmed. And whether the Michael Jackson biopic will be released as one or two films is still under discussion, the company said.

On a call with analysts to discuss Lionsgate’s fourth quarter 2025 financial results, CEO Jon Feltheimer said it is “likely that we will move Michael” out of the company’s fiscal 2026, which runs until March 31, 2026, and into the fiscal 2027 year beginning April 1, 2026.

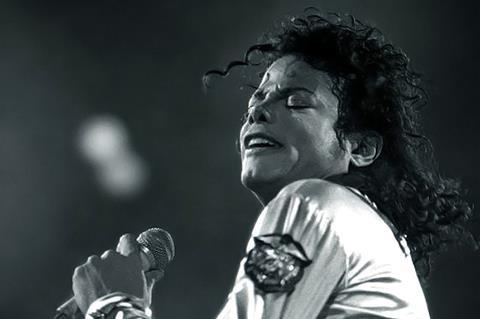

He added that Lionsgate will be “announcing a definitive release strategy and timing in the next few weeks” and that the company is “excited about the three and a half hours of amazing footage” it has seen from the film, directed by Antoine Fuqua and produced by Graham King.

Later in the call, Adam Fogelson, chair of Lionsgate’s motion picture group, said that given the subject matter, “whether or not that can be fit into one movie comfortably or not is a question that we are absolutely asking” and would be “ready to answer more specifically in the coming weeks.”

Michael was originally set for release this April and then moved to an October date. Speculation began about another shift when the film was not mentioned during Lionsgate’s presentation at last month’s CinemaCon.

Commenting on Lionsgate’s fourth quarter results, the first since its studio business was split off from the Starz streaming and TV unit, Feltheimer said the company had “a strong quarter despite a difficult operating environment.”

The company’s fourth quarter revenue was $1.1bn, operating income was $94.2m and adjusted OIBDA was $138.3m, up 49% year-over-year.

Lionsgate’s motion picture segment saw revenue grow 28% to $526.4m, while segment profit grew 65% to $135.3m. The growth was driven, the company said, by the box office success of releases including Den of Thieves 2: Pantera and Flight Risk.

Commenting on the idea of film tariffs recently proposed by President Donald Trump, Feltheimer said Lionsgate is “taking a wait and see approach.”

“We think that some version of a federal tax credit is better for the business,” he added. “There’s probably some smarter ways other than tariffs to support our business and support the overall US economy.”

![[L-R]: Amanda Villavieja, Laia Casanovas, Yasmina Praderas](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/6/4/1/1471641_pxl_20251224_103354743_618426_crop.jpg)

No comments yet