2023 did not usher in the 100th birthday celebrations The Walt Disney Company will want to remember amid cost-cutting, production halts due to the dual Hollywood strikes, and theatrical flops.

CEO Bob Iger, who came out of retirement in November 2022 to take back the top job following the abrupt departure of his successor-turned-predecessor Bob Chapek, has spent the last year cleaning the Mouse House.

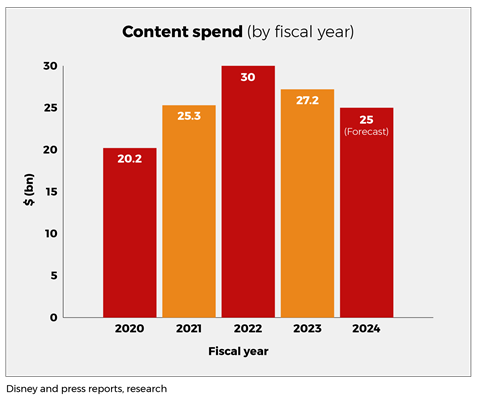

He restructured the company into Disney Entertainment (comprising theatrical and streaming), Sports, and Experiences and Products, cut 8,000 jobs, and reined in the massive content spend that has been a hallmark of all Hollywood companies in the rush to scale up streaming operations during the pandemic.

Iger has said his work fixing problems is nearing an end as the company looks to build. It has scheduled $7.5bn in cost savings by the end of 2024. Projected spend through 2024 has been cut from $27.2bn in fiscal 2023 to around $25bn, of which $15bn will be dedicated to the entertainment segment.

Disney’s stock grew marginally in 2023 from around $87 to just above $90 in a challenging 12 months. The company is locked in a proxy battle with activist investor Nelson Peltz and others, faces cable TV headwinds, and a challenging ad market. On the bright side, the parks and experiences segment is performing robustly and Disney expects its streaming services including Disney+ to become profitable before the end of fiscal 2024.

Financials

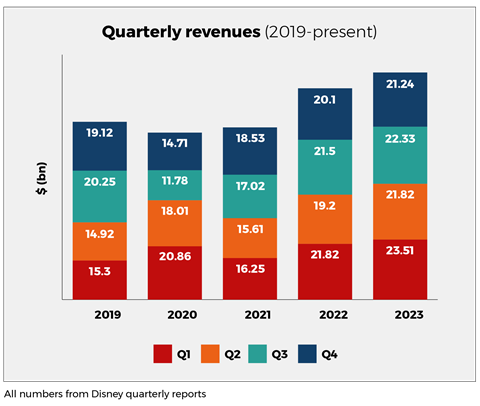

Annual revenues for fiscal 2023 climbed 7% year-on-year to reach $88.9bn, while Q4 revenues for the period ended September 30, 2023 gained 5% to reach $21.2bn. Revenues for content sales and licensing – the segment which includes theatrical distribution – declined 3% in Q4 to $1.86bn, while operating loss increased from $8m in Q4 2022 to $149m.

Cost cuts and lower spend has quadrupled free cash flow year-on-year from $1.1bn to $4.9bn, driven in part by savings on production costs during the Hollywood work stoppages, which shut down all Hollywood studio and streamer production from May to November. Free cash flow is forecast to grow “significantly” in fiscal 2024 to pre-pandemic levels (it reached $8.7bn in 2017 and $9.8bn in 2018).

Fourth quarter streaming revenues climbed 12% to just over $5bn and operating loss fell by 70% to $420m due in part to higher subscription fees, and growth among Disney core membership (excluding Disney+ Hotstar) and Hulu.

Theatrical box office, distribution

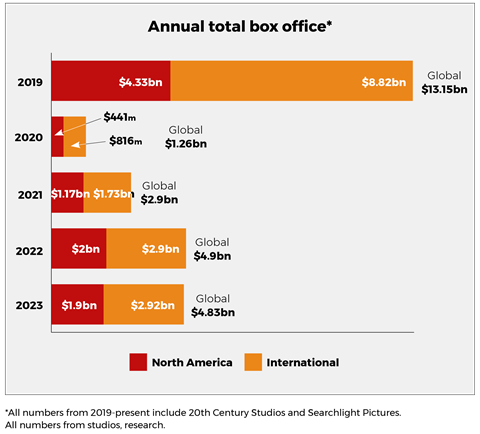

Disney, historically a box-office titan, endured a below-par year at the box office by its lofty standards, with core brands disappointing on a number of occasions. For calendar year 2023 the company finished second in the Hollywood rankings behind Universal Pictures – the first time it failed to lead the rankings since 2016 – as its global box office reached $4.83bn, comprising $1.9bn from North America and $2.92bn from international. All figures include the 20th Century Studios and Searchlight Pictures releases after Disney acquired 21st Century Fox’s entertainment assets in 2019.

2023 box office trailed Disney’s $4.9bn global haul in 2022 and brought another unwelcome statistic: disregarding pandemic years 2020 and 2021, this was the first year since 2014 when no Disney film grossed more than $1bn at the global box office.

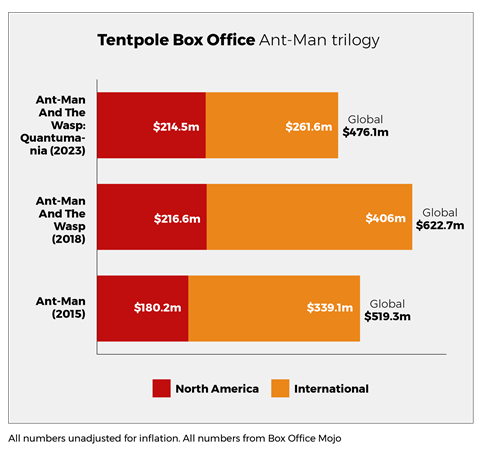

The race to feed Disney+ has led to a surfeit of Marvel Studios content anchored by multiple TV shows, leading to well-documented “superhero fatigue”. Feeding into the malaise is the inter-related nature of each Marvel film and show, which anecdotally has made it hard for casual viewers to tune in to particular titles.

Ant-Man And The Wasp: Quantumania stumbled in February, opening theatrically on $106.1m in the key market of North America and going on to fall well short of its 2018 predecessor Ant-Man And The Wasp.

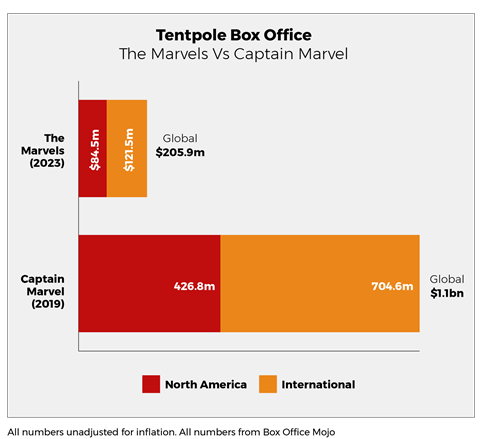

November release The Marvels starring Brie Larson opened on $46.1m in North America to score the lowest debut by a Marvel film. The cumulative box office in North America fell well short of $100m – previously unthinkable for a Marvel Studios release – and a huge way behind the $1bn-plus success of Captain Marvel in 2019.

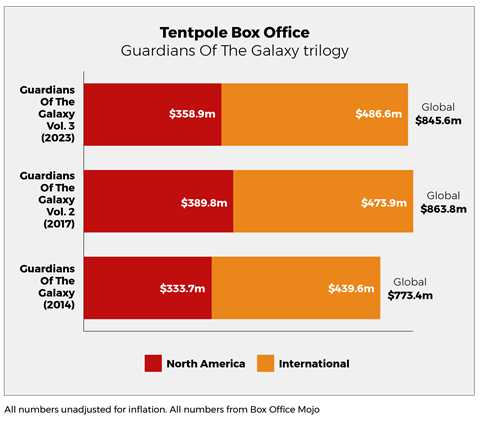

Only Guardians Of The Galaxy Vol. 3 acquitted itself well in 2023, after it kicked off summer season in May and earned $358.9m in North America and $486.6m internationally for a global total of $845.5m. The numbers compare well to the two prior instalments. Coincidentally, the Guardians franchise has been directed by James Gunn, the man who now co-heads ambitious rival superhero stable DC Films for Warner Bros.

2024 will see only one Marvel Studios release – Deadpool 3 on July 26 – after Captain America: Brave New World and Blade were pushed into 2025 due to production delays stemming from the Hollywood strikes. 2018’s Deadpool 2 earned $324.6m and $785.9m in North America and globally, while Deadpool back in 2016 took $363m and $782m, respectively.

The sole Pixar release in 2023 was Elemental, which started poorly in cinemas with a $29.6m June launch in North America but slowly gathered pace through strong word of mouth, finishing on $154.4m in North America and $496.4m worldwide.

This was encouraging news for Disney executives after the company sent Pixar trio Soul, Luca and Turning Red straight to streaming during the pandemic, in 2020, 2021 and 2022 respectively. Disney had little choice but to adopt this strategy during cinema closures, although pundits and analysts have speculated it may have diminished theatrical must-see brand value.

By June 2022, with vaccinations widely available and signs that the pandemic was receding, Toy Story spin-off Lightyear became the first Pixar film to open exclusively in cinemas since Onward in March 2020. A lukewarm critical response foreshadowed audience sentiment and the film only managed $118.3m domestically and $226.4m worldwide, way off the $1bn-plus worldwide grosses Toy Story 3 and 4.

Pixar’s sole new 2024 release is Inside Out 2 (June 14), which will seek to emulate the 2015 original’s $356m and $858m domestic and global box office, respectively. Interestingly, the studio announced in early December that it will release Soul, Turning Red and Luca theatrically for the first time in the first quarter of 2024 as it seeks to bolster box office from a slimmer distribution slate caused by strike-induced production delays.

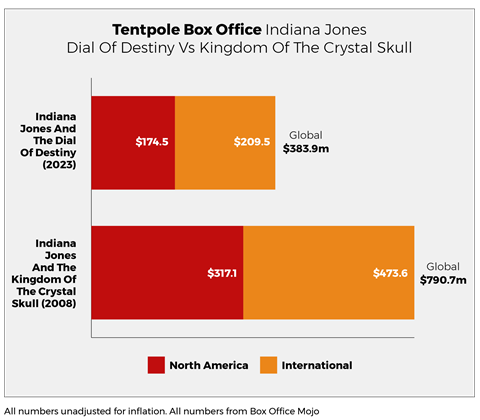

Lucasfilm did not fare much better in 2023 as the company invited octogenarian Harrison Ford to pick up his fedora and whip for one last adventure. The familiar storyline on Indiana Jones And The Dial Of Destiny by and large left audiences cold and the film flopped on $383.9m worldwide – way behind the last instalment, 2008’s Indiana Jones And The Kingdom Of The Crystal Skull, which grossed more than double that tally at $790.7m.

While there have been several Star Wars spin-off TV shows on Disney+ in 2023 (The Bad Batch S2, The Mandalorian S3, Ahsoka), there has not been a feature film since Episode IX: The Rise Of Skywalker in 2019 and no release is planned for 2024. However, Disney is prioritising new features and has said it will start production this year on Jon Favreau’s The Mandalorian & Grogu, with a new saga starring Daisy Ridley also in the pipeline alongside a Star Wars Universe feature to be directed by James Mangold.

Disney’s big animation release of 2023 was the musical Wish, which reportedly cost in the region of $200m and was the studio’s final release of the year. It opened in November to poor reviews and by the third week of January had earned a paltry $63.4m in North America and $169.8m internationally, resulting in a $233.2m global tally.

The live-action animation division endured mixed results in 2023, with remake The Little Mermaid opening in May and earning $298.2m domestically and $568.9m worldwide, a solid result before one takes into account the reported $250m production cost, which will have lowered the profit margin. Theme park ride adaptation and July release Haunted Mansion grossed a disappointing $67.7m in North America and $103.3m worldwide.

On January 23 Disney’s film division earned 20 Oscar nominations, led by Searchlight Pictures’ Poor Things on 11. The Emma Stone starrer stands at $21.1m in North America and $13.3m internationally for $34.4m globally, although Searchlight’s distribution executives will be looking to capitalise on its nominations at the box office.

2024 priorities

Iger wants to put the ongoing activist investor battle with Nelson Peltz’s Trian Partners, former Marvel head Ike Perlmutter and former CFO James Rasulo to bed. Ahead of the undated annual shareholders’ meeting he will have been reassured by shareholder ValueAct Capital Management’s pledge to support Disney’s nominees for the board of directors.

The CEO will also want to address succession planning before he steps down when his term ends in 2026. Another core priority is sustaining profitability at the streaming business, which Iger has said can become profitable by the end of fiscal 2024.

Global membership at the flagship Disney+ has reached 150.2 million including Disney+ Hotstar. Disney has taken complete ownership of Hulu after acquiring Comcast’s 33% stake. Subscribers at Hulu SVoD-only are up to 43.9 million and finding the optimal way to exploit the platform is another key area of interest.

Turning to theatrical distribution, Iger has said he wants to pursue a strategy of quality over quantity. Top of mind will be the need to reclaim audience faith in core brands, one being Marvel Studios. The latter has just fired Jonathan Majors following the actor’s assault conviction and must now rethink casting and major narrative arcs because Majors played a key character in the Marvel Cinematic Universe and was preparing to star in 2026 release Avengers: The Kang Dynasty.

With the Hollywood strikes over, Iger and his lieutenants can at least look forward to uninterrupted production. 2024 highlights besides Deadpool 3 and Inside Out 2 include Mufasa: The Lion King. Beyond that, 2025 promises the third instalment in James Cameron’s high-grossing Avatar franchise, Fantastic Four, and a live-action Moana adaptation.

No comments yet