The first billion-dollar month of the pandemic era in North America, strong recoveries in territories including the UK, and some welcome depth in the market across multiple genres — those are the positives giving encouragement to the exhibition sector in summer 2022. On the flip side, however, are challenges in China for many US studios, the loss of Russia as a market, the paucity of releases and growing concern about the cost-of-living-crisis.

In North America, box office for the year up to August 17 stood at $5.15bn — up from $1.89bn for the same period in 2021 and $1.92bn in 2020 (which included a couple of strong months at the start of the year before the pandemic hit). While that is a welcome recovery, North American box office remains 31% down on the $7.48bn grossed for the same period in pre-pandemic 2019.

But it is not so much that blockbusters are pulling in smaller audiences — indeed Top Gun: Maverick ($683m at press time) is now the sixth-biggest film of all time at the North America box office. Instead, the significant factor in the 2022 shortfall is the drop in number of wide releases. This year, there were 42 titles released into at least 2,000 cinemas in North America from January 1 to August 17 — compared with 73 in 2019, and 71 in 2018. That is a drop in wide releases of 41%‑42% on the pre-pandemic years.

“If you’re going to get anywhere near pre-pandemic levels, first of all, you have to have more films out there,” comments Paul Dergarabedian, senior media analyst at data gatherer Comscore — who adds that it was especially the case in the first four months of this year when box office was typically dominated by a single film on any given weekend. “And this business cannot exist on one blockbuster a month,” he says.

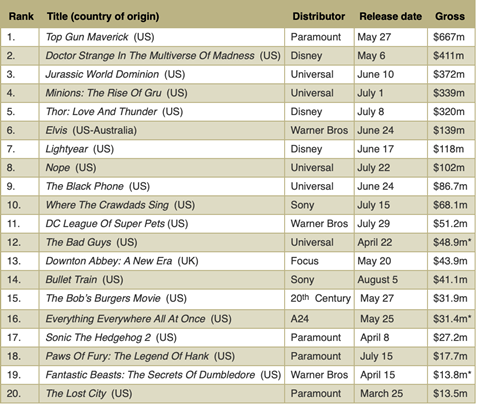

Since the summer season began with the release of Doctor Strange In The Multiverse Of Madness on May 6, a return closer to pre-pandemic normalcy has been noted, with two or more titles performing robustly at the same time. Still, Comscore’s top 20 chart for the North America summer box office includes five titles that were released in March or April — with takings for the summer period (after May 6) enough to win them a place in the bottom half of the chart. With a full summer release schedule, those titles would have likely been squeezed out of the top 20.

North America box office (May 6 - August 11)

Source: Comscore *Gross for eligible date period only

In the years immediately prior to the pandemic, US studios were increasingly insisting that the whole notion of blockbuster seasons — for the summer, and then the winter holiday period — was outdated thinking, and that major tentpole titles could be released successfully any month or week of the year. “If you’re going to talk the talk of 52 weeks a year, you’ve got to walk the walk, and they haven’t really been doing that [since the pandemic],” says Dergarabedian. “The studios are still finding their footing, not only when to release films in theatres, but which ones they’re going to devote the time, energy and resources to having a theatrical release.”

Summer surge

The North America box office this year is 31% down on pre-pandemic 2019, but the picture for the summer is rosier. Box office for the 15 weeks beginning the first Friday in May is $3.19bn — just 20% down on the same period in pre-pandemic 2019 and 2018, and only 10% down on the equivalent 15-week period of 2017. July saw the first $1bn calendar month since 2019.

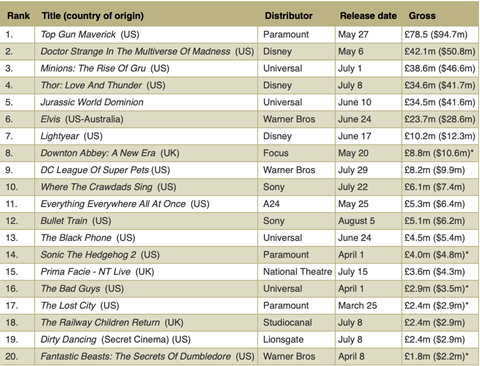

The key international market of UK/Ireland shows a similar shape, although overall the recovery is stronger than in North America. For the first seven months of 2022, total box office for UK/Ireland was £619.8m ($742m) — just 20% down on the equivalent period of pre-pandemic 2019. Narrow the focus to the summer period, and an even brighter picture emerges. For the 14 weeks beginning the first Friday in May, UK/Ireland cinemas generated £335.6m ($404.4m). That is 16% down on the equivalent period of 2019, just 2% down on the same 14-week period of 2018 (which was impacted by World Cup football), and only 1% behind the £339.2m ($408.8m) generated in this period in 2017.

“Overall, I think we have to be happy the UK and Ireland is one of the leading global territories when it comes to sector recovery,” comments Andy Leyshon, CEO of the UK’s Film Distributors’ Association. “You have to remember the immediate pre-pandemic years of 2018 and 2019 were coming in at near 50-year highs for cinema admissions, so to be within 20% of those levels [for the year to date] after all we’ve been through is astonishing.”

Dampening the buoyant mood is news that the heavily debt-burdened Cineworld Group — which operates Cineworld and Picturehouse cinemas in the UK, and Regal in the US — is exploring options for survival, including insolvency proceedings. The exhibitor had blamed the patchy upcoming release calendar for compounding its liquidity problem.

Phil Clapp, CEO of the UK Cinema Association, echoes Leyshon’s positive perspective on the success achieved so far in 2022, while also sounding a note of caution about the immediate future. “There aren’t a huge number of major films between now and the second half of October, which is impacting in particular on those operators who rely primarily on blockbuster content to draw in audiences,” he comments. “Clearly this is not a UK-specific issue, and I suspect it’s partly a result of the delayed impacts of the pandemic on production and post-production of films. Certainly, we’re hearing that post-production houses are inundated right now.”

While the UK/Ireland box office chart for this summer looks not too dissimilar to North America in terms of titles, there have been notable variations this year within other international territories — and not just because of local films. In Mexico, for example, Top Gun: Maverick is only the 10th highest-grossing film of the year (to August 12), with $14.8m. Jurassic World Dominion ($43.2m to August 12) is the top title of 2022 in the territory. Horror tends to over-index in Mexico, where The Black Phone ($16.2m) beat Top Gun: Maverick.

April release Fantastic Beasts: The Secrets Of Dumbledore disappointed in the UK/Ireland, where it is only the 11th-biggest film of the year, despite the strong British associations with the source material, characters, cast and filmmakers. In Germany, the film is the second-biggest of 2022, with $28.8m, right behind Top Gun: Maverick ($30.7m to August 12).

UK & Ireland box office (May 6 - August 11)

Source: Comscore *Gross for eligible date period only

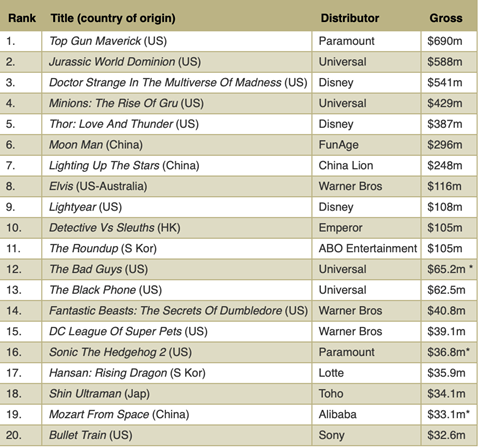

In China, according to data gatherer Artisan Gateway, total box office of $3.48bn (to August 21) is running 27% behind 2021 for the equivalent period — one of the very few territories in the world where box office lags not just pre-pandemic times but also the performance of last year. Significant lockdowns in the country this year are the culprit, although the relative lack of major US studio titles being afforded a China release in 2022 must also be a factor. That fractured pattern of releasing in China has impacted Comscore’s international box office chart for the summer. Jurassic World Dominion, in second place, benefited from release in China, where it grossed a handy $158m; Disney/Marvel titles such as Doctor Strange In The Multiverse Of Madness and Thor: Love And Thunder have missed out on a China boost.

International box office (May 6 - August 11)

Source: Comscore *Gross for eligible date period only

The declining China market is impacting global box office overall, which reached $5.02bn for the 14 weeks beginning May 6 — 35% down on the equivalent period of 2019.

North American box office once again running ahead of China; the return of seasonality in the blockbuster release calendar — those are signs of the clock being turned back, and not just to immediate pre-pandemic times. The same might be said of the notable lack of female protagonists in the major titles released in 2022: the year has lacked an Encanto, Mamma Mia!, Wonder Woman or Black Widow. While titles such as Jurassic World Dominion and Thor: Love And Thunder boast key female characters, it has been left to the likes of screwball adventure The Lost City ($191m worldwide) and literary adaptation Where The Crawdads Sing ($98m) to carry the flag for actual female-driven stories. “I just want to see movies reflect the real world, and not every hero is male,” comments Dergarabedian.

Turning back time

For 2022, data analysis and insight company Gower Street Analytics is forecasting $30bn worldwide, $8.27bn for North America, and £998m ($1.31bn) for UK/Ireland. That would put global box office level with 2009, North America just ahead of 2001, and UK/Ireland between totals achieved in 2008 and 2009 — essentially losing a decade of growth, and more in the case of the North America domestic market.

It is hard to assess the impact of shrunken theatrical windows on these numbers. Dergarabedian calls the theatrical window “a discussion that needed to be had”, welcoming dynamic windowing, “where the movie tells you how long it should be in the theatre” — three months in the case of Top Gun: Maverick, which landed on digital on August 24.

For Clapp, and despite Cineworld woes, the fact many of his UK exhibitor members are debating topics such as the knock to box office of untypically hot summer temperatures and the impact this November of World Cup football, as opposed to existential threats such as the pandemic, represents a welcome return to normalcy for the sector.

“Without sounding glib, it’s reassuring to be back to something like the normal ebb and flow,” he says. “However, this is not to suggest minds are not also focused on how we best take the remaining steps to get back to pre-Covid levels of success, or how we push on from there.”

![[L-R]: Amanda Villavieja, Laia Casanovas, Yasmina Praderas](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/6/4/1/1471641_pxl_20251224_103354743_618426_crop.jpg)

![[L-R]: Amanda Villavieja, Laia Casanovas, Yasmina Praderas](https://d1nslcd7m2225b.cloudfront.net/Pictures/100x67/6/4/1/1471641_pxl_20251224_103354743_618426_crop.jpg)

No comments yet