Almost 42% of the total budget of the average European film now comes from public financing support, according to European Audiovisual Observatory (EAO) figures published this week.

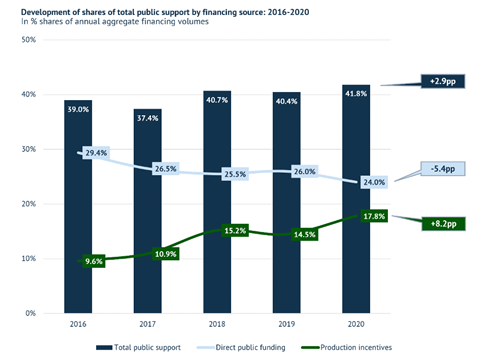

The share of total public financing for European films grew from 39% in 2106 to 41.8% in 2020, EAO discovered.

The public support came in two forms: direct public funding and production incentives.

The largest source of film financing for European fiction feature films remains direct public funding. However, this has decreased over time, down to 24% in 2020 compared to 29.4% in 2016.

In contrast, the share of production incentives has increased significantly, from 9.6% of total financing in 2016 to 17.8% in 2020. This increase stemmed primarily from the growing role of production incentives in medium and large markets. Italy, for example, introduced its 40% tax credit in 2016.

Broadcaster investments as a financing source have declined too, particularly in large markets where they have fallen from 29.7% of a budget in 2016 to 22.9% in 2020. The drop most affected high-budget and super-high-budget films. The share of broadcaster investments also declined in small and medium markets, but only by 2 and 1 percentage points.

However, pre-sales remained comparatively steady over time, and accounted for 14.6% of budgets in 2020.

More than nine out of 10 films are partly financed by a producer’s own investments. Producer investments stood at 17.8% of budgets in 2020.

Other financing sources – including private equity, debt financing and in-kind investments – accounted for 5% of budgets in 2020.

The EAO report found that two-thirds of European films released between 2016 and 2020 had a budget of less than €3m. The median budget of films over the period was €2.13m.

The report - titled ’Fiction film financing in Europe: Overview and trends 2016-2020’ - is based on data analysing financing plans for 2,490 European live action films released between 2016 and 2020.

The EAO warned of a ‘French bias’ in the figures given the size of the French market: French films represented 33% of the sample films and 49% of the cumulative financing volume in the total data sample.

The EAO noted that the share of direct public funding in small markets is more than twice as high as that in large markets. Direct public funding accounted for 58.5% of a film’s finance in small markets compared to 19.8% in large markets.

No comments yet