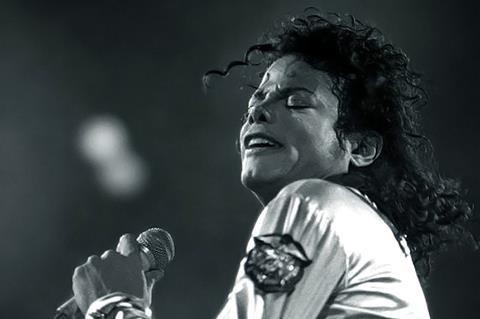

Lionsgate and Graham King’s upcoming Michael Jackson biopic is on track to generate more in-state spending than another other film in the 14-year history of California’s tax credit programme, the California Film Commission said on Monday (March 6).

Screen understands Michael will generate an estimated $120.1m in qualified in-state spending, which refers to wages paid to below-the-line workers and payments to in-state vendors.

State laws forbid the film commission from saying how much a project is forecast to generate overall, including unqualified spend, which covers payments to above-the-line individuals such as producers, actors, directors and writers.

Only the qualified portion of a budget is eligible for the state’s tax credit. Michael is in line to receive $21.1m in tax credits and is one of three non-independent projects among 24 conditionally selected for the latest round of the state’s Film & Television Tax Credit Program.

The 24 projects combined will generate an estimated $423m in qualified spending and $662m in overall spending across California. The state is allowed to say how much aggregated projects will generate in overall spend.

The other two non-independent projects are MGM’s The Thomas Crown Affair remake and an untitled Disney live-action feature, which are in line to receive $13.8m and $11.3m in tax credits, respectively. Combined with Michael, these two projects are expected to generate $65m in qualified spend and $433m in total spend.

The 21 independent films will generate a combined $172m in qualified and $230m in total spend. Six independents with budgets over $10m – Live, Puritan II, Shell, The Invite, The Knockout Queen and Unstoppable – are on track to generate a combined $96m in qualified and $128m in total spending.

California Film Commission executive director Colleen Bell hailed the budget range of the projects and added, “The program is an important tool for maintaining our competitiveness and curbing runaway production. We are working harder than ever to keep entertainment production here in California, where it belongs.”

Half of the 24 projects plan to film outside the Los Angeles 30-Mile Studio Zone. The film commission received 58 applications during the January 30–February 6 feature film tax credit application period and has reserved $81.7m in tax credit allocation for this cycle’s projects.

The next application period for features will be held from July 24-31 and the next application period for TV projects will be held from March 6-20.

No comments yet