Indonesia has seen a boom in box office for local films despite the growth of streaming services, but challenges remain to export its hit horror and family features to global audiences.

Indonesian audiences have been embracing a growing wave of local films post-Covid, pushing cinema admissions to new heights and ushering in a cinematic golden age for the country.

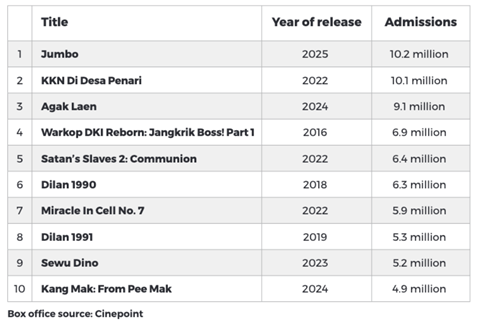

Seven of the top 10 biggest ever local films were released from 2022 onwards, with the latest being Visinema’s animated feature Jumbo, which now ranks as the biggest local film ever, pulling in almost 10.2 million admissions earlier this year, and the second highest overall behind 2019’s Avengers: Endgame.

In 2024, Indonesian productions generated 80 million admissions and commanded a 65% market share, both breaking all-time records in the country. Leading the pack was Agak Laen, which took 9.1 million admissions and became the first local comedy to top the annual box office since Warkop DKI Reborn: Jangkrik Boss! Part 1 in 2016.

Box office for Indonesia films rebounded fast post-pandemic and recorded 57 million admissions in 2022, up 12% on pre-Covid 2019. That year, MD Pictures’ horror feature KKN Di Desa Penari became the first local film to reach 10 million admissions.

“Cinemagoing is one of the more affordable forms of entertainment, with ticket prices selling at $2.50-$3.50”, says Angga Dwimas Sasongko, founder of the Visinema Group. “While Indonesian films were on the way up in the last decade, no one had expected the post-Covid surge and the unprecedented success of Jumbo.”

Family adventure Jumbo represented a major leap for Indonesia’s animation industry as no local animated feature had ever entered the top 10 chart of all time.

This year’s local box office is tracking well and not just because of Jumbo. A total of 10 local films had topped the 1 million admissions benchmark at time of press, including horror Sugar Mill (4.7 million) and romantic drama Komang (3 million) — both released during the lucrative Eid (otherwise known as Hari Raya) holidays in late March along with Jumbo. Further hits include horror Haunting Of Mount Gede (3.2 million admissions) and time-travel romance Sore: Wife From The Future (3 million).

Opening windows

Indonesia’s streaming landscape has evolved significantly in recent years. Vidio, backed by Emtek Media Group, has produced almost 100 original series, leading the market with reportedly 4.9 million paid subscribers. Other local players include Bioskop Online, KlikFilm and Vision+, while global streamers like Netflix and Prime Video have launched local original film and series productions to cater to local audiences.

Streaming platforms are competition for cinemas, but also crucial to the ecosystem. “OTT is the second window of revenue stream post-cinema for producers as other platforms like TV are no longer licensing movie titles,” says Edwin Nazir, chairman of the Association of Indonesian Film Producers (APROFI). “OTT makes movies more accessible and increases movie-watching habits, while cinemas offer a different experience, a communal experience that the Indonesian audiences love. Cinemas and OTT complement each other.”

Facing the streaming boom, the four-month exclusive theatrical window — nearly three times longer than the 45-day window in the US — is instrumental in keeping the theatrical momentum of local releases and allowing both segments to thrive.

A unique feature of Indonesia’s massive film ecosystem is that producers double up as distributors because exhibitors handle the scheduling, but not distribution. While producers can save on distribution commissions, “juggling multiple projects at different stages can be challenging, especially when switching between creative decisions and business considerations,” says Shanty Harmayn, founder and co-CEO of studio Base Entertainment.

“I’ve grown to appreciate how this hands-on approach helps me stay on top of best practices and use that insight as we keep learning what audiences truly respond to.” Her company’s slate includes upcoming releases Mothernet by Ho Wi Ding and animated feature Garuda Di Dadaku.

HV Naveen, founder of Falcon Pictures, explains the unique situation: “Some 90-95% of theatrical distribution is dominated by three major cinema networks: Cinema XXI, Cinepolis and CGV. XXI alone controls up to 60% of the screen share. There’s no structural space or incentive for independent distribution companies to thrive.”

Falcon Pictures is a consistent hitmaker, with five titles topping the local chart of all time, including action comedy Warkop DKI Reborn: Jangkrik Boss! Part 1, romantic dramas Dilan 1990 and Dilan 1991, comedy drama Miracle In Cell No. 7 and supernatural comedy Kang Mak: From Pee Mak.

Meiske Taurisia, founder of boutique production house Palari Films, says that the absence of standalone film distributors “used to be seen as a handicap for the industry, but it has become one of the reasons why we bounced back quickly from the pandemic”.

“Producers have always been the ‘direct’ supplier for cinemas — we find financing resources to develop the projects until the release including promotion activities,” she explains. “Post-pandemic, audiences were looking for films and producers were agile to increase their productivity and raise the quality. Cinemas became more and more open to taking Indonesian films.”

While the box office for Indonesian releases is rocketing, last year’s overall admissions of 126 million remained down on 2019’s 154 million. “Imports have not picked up the slack,” says Sigit T Prabowo, who runs data platform Cinepoint.

“Hollywood blockbusters are not the size they used to be. Marvel movies used to clear 3 million admissions easily. Now they struggle to get past 1.5 million. The last big Hollywood hit was 2022’s Avatar: The Way Of Water with 7 million.”

Family and horror boom

Bolstered by the runaway success of family-oriented Jumbo, family themes will continue to be a key focus for the Visinema Group. Its latest release is Call Me Dad, which opened on August 7 and marks the group’s first international collaboration, with Korea’s CJ ENM as co-producer. The heartfelt drama about a debt collector who receives a young girl as collateral is produced by Anggia Kharisma of Jumbo and is an adaptation of 2020 Korean hit Pawn.

Following the success of 2022’s Miracle In Cell No. 7, also a remake of a Korean film, Falcon Pictures has created sequel 2nd Miracle In Cell No. 7 and has an animated version and further spin-off in the works.

“We don’t just do remakes, we build on them,” says Naveen. Similarly, comedy horror Kang Solah x Nenek Gayung (From Kang Mak), the second instalment of the local remake of Thai hit Pee Mak, is set for release in September, with a third instalment from the franchise in the pipeline.

A variety of genres prove popular with Indonesian audiences from teen love stories to sentimental dramas, but horror remains the most dominant by far with a massive 50 titles already released this year.

“Emotional and immersive experiences have become central to the theatrical experience post-Covid,” says Naveen. “Horror films have greatly benefited from this and now account for 60-70% of the best-performing theatrical titles.”

Horror is also the most exportable. Titles from MD Pictures, Magma Entertainment and Rapi Films such as KKN Di Desa Penari, Qodrat and Satan’s Slave 2: Communion made it to Southeast Asia, but Indonesia remains the primary focus. Most of the studios enjoy their biggest commercial successes and receive the bulk of their revenue from the local box office.

Korean investment

Despite major growth areas, the industry is marked by an absence of local sales agents that can elevate Indonesian cinema’s presence on the global stage. Last year, South Korea’s Barunson E&A acquired worldwide sales rights to Base Entertainment’s horror Respati, which went on to screen at Sitges and Fantastic Fest.

“Indonesian cinema is still in the early stages of being recognised by the global market and most international buyers outside Asia are not familiar with it,” says Sylvie Kim, head of international business of Barunson E&A, the company known as the producer of Oscar-winner Parasite.

“We started with well-made genre titles as it’s easier to initiate them with more entertaining and commercial genre titles. We will continue to introduce more unique and diverse genres from promising creators.”

The company’s growing Indonesian portfolio includes mystery thriller Smothered, produced and written by Joko Anwar through his outfit Come and See Pictures, and musical film Rangga & Cinta, based on a beloved IP directed by Riri Riza and produced by Mira Lesmana. There are also the remake rights to three comedies from start-up Imajinari: Agak Laen; its second instalment Agak Laen: Menyala Pantiku!; and Better Off Dead from comedian-turned-director Kristo Immanuel.

Korea’s Showbox is also making inroads into Indonesia, having secured international sales rights to Palari Films’ Sleep No More. The body horror reunites director Edwin and producer Meiske after 2021’s Vengeance Is Mine, All Others Pay Cash — the first Indonesian film to win Locarno’s Golden Leopard.

Screen limitations

Indonesia has an estimated 2,350 cinema screens serving a massive population of 280 million, meaning the country is severely underserved on the theatre front. Most of the screens are also located in the greater Jakarta area and on Java, an island that is home to around 56% of the Indonesian population.

New cinema networks are expanding in second and third-tier cities, but still not fast enough to meet the rising demand. Last year, with around 150 local films screened in theatres (compared to around 120 in 2019), three local titles were released every week on average on top of Hollywood and other international features.

With limited slots, each title is fighting for screens and its showtimes will be greatly reduced if it underperforms on its first weekend, making it particularly hard for non-commercial films, which take time to build good word-of-mouth.

“The screens are limited for arthouse films, which attract smaller audiences compared to commercial blockbusters in Indonesia,” says Forka Films founder Ifa Isfansyah. “However, the gap has been narrowing in recent years.

“Though these films remain niche, their presence is vital in enriching the local cinematic landscape — not just competing at the box office but expanding how we understand cinema culture.”

A top festival berth can significantly benefit the international sales and domestic visibility of local arthouse films. Before, Now & Then won a Silver Bear at the Berlinale in 2022 before securing sales to more than 20 territories, while 2021 drama Yuni drew 120,000 admissions in Indonesia after winning the Platform prize at Toronto.

Both films were produced by Forka Films’ Ifa for his director-wife Kamila Andini, who is prepping her latest project Four Seasons In Java.

While the commercial sector is mostly self-funded, finance remains a key challenge for artistic films aimed at the international market. Forka Films has previously received support from European soft grants such as the Hubert Bals Fund, NFF+HBF and Sorfond. “Based on such funds, some private equity is willing to join for the gap financing,” Ifa notes.

The country’s first ever Ministry of Culture was established last year to support and promote Indonesia’s rich and diverse culture after the Ministry of Education, Culture, Research and Technology was split into three separate ministries under the new office of president Prabowo Subianto.

Dana Indonesiana, a cultural endowment fund for the creative sectors, previously launched a matching fund programme that matches external international funding up to $154,000 (idr2.5bn) per film project. Four Indonesian films were selected as the first recipients in May 2024, including Mouly Surya’s This City Is A Battlefield, which closed this year’s International Film Festival Rotterdam, and Tumpal Tampubolon’s Toronto 2024 selection Crocodile Tears.

The programme is now folded into the Ministry of Culture and has recently been relaunched. “While not yet as strong as European models, this is a crucial first step toward a more sustainable funding system in Indonesia,” says Ifa, who is also a co-founder of Jogja-NETPAC Asian Film Festival (JAFF), which will hold its 20th edition this November.

While initiatives like Dana Indonesiana and international co-production deals have made headlines, the industry is hoping that clearer policies will be created to empower creative filmmakers to innovate and thrive. These include direct subsidies and tax breaks to defray production costs particularly for artistic films, and tax rebates and streamlined co-financing access to fuel global collaborations.

Upcoming works from visionary Indonesian filmmakers include Joko’s Ghost In The Cell, the horror master’s first comedy in two decades; acclaimed actor Reza Rahadian’s directing debut On Your Lap; and Levitating from Wregas Bhanuteja, whose previous drama Andragogy bowed at Toronto in 2023.

No comments yet